When Should Nations Sell Their Data?

Service economies might have to treat data as a strategic asset beyond privacy politics

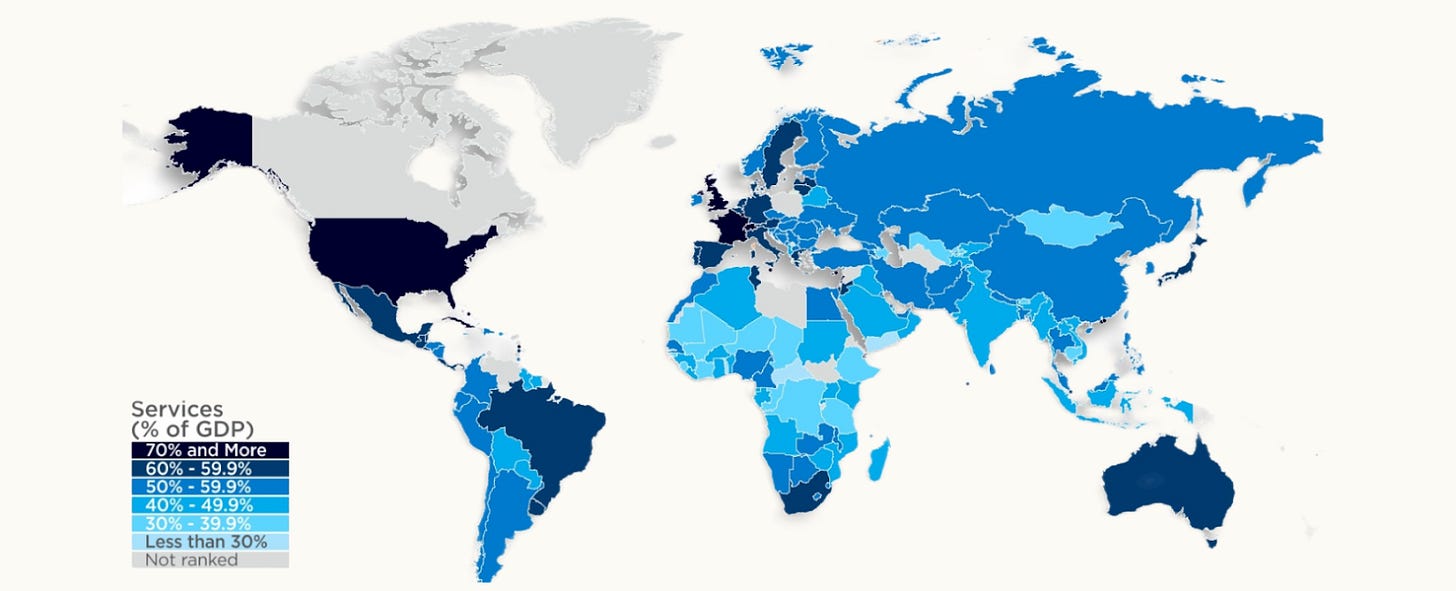

In recent decades, the measure of an economy’s progress has been the growth of its service sector: the ability of its population to work out of gleaming skyscrapers instead of smog-filled industrial plants, the degree to which its growth is divorced from the material constraints of physical labour. Strongholds of the fastest growth often still bear marks of that departure: I write today’s piece from the 60th floor of a Hong Kong skyscraper that rises from the vestiges of a now almost-irrelevant industrial harbour, against the backdrop of a buzzing services industry that seems sure to have left its humble physical roots behind.

AI, however, threatens to flip that logic. It seems that AI systems will master the cognitive domain before the physical, and thus displace white-collar before blue-collar work. That means many economies that thought they were doing particularly well in adjusting to the 21st century’s logic now find themselves at the greatest peril. Most countries outside America hold no large stake in AI progress itself, but their labor markets are still vulnerable. They lack leverage and leeway, as AI-driven revenue might well accrue outside their capitals and on the US shores; and outside of the income tax bracket and in corporate tax havens. Economies like Singapore, the UK, or the Nordics, whose economic success relies on highly educated service labor, are highly exposed to having their workforce displaced and their growth stymied.

This piece tells one story of how they might still pivot. The threatened service economies still hold a key asset: the valuable data required to hasten the advent of transformative, disruptive AI agents. In some AI futures, leveraging this data at scale would be one promising path to steer clear of the most disruptive futures for service economies. But by political consensus and legal default, even private individuals are limited in selling and using highly valuable data – not to speak of firms and nation states. This is the consequence of a strategic mistake: existing data governance was built for a bygone era in which data was best understood and governed by its relation to personal rights.

Yet countries would be justified to change their approach. The data embodied within their skilled workforce is not accidental, but a cultivated asset – developed through costly investments in education, talent attraction, and structural preconditions for a thriving services sector. That makes it nations’ right and responsibility to leverage this asset well. If they want to avoid being on the losing side of AI diffusion, they instead need to find a way to transform it into a lasting advantage. To do so, they would have to relinquish the view of extensive data privacy as sacrosanct right, and craft policy to time and shape the sale of their fleeting data treasures.

Technical Underpinnings

This future I describe is, of course, technologically contingent. As so often in AI, what I suggest is not guaranteed to be a worthwhile strategy, and a technical shift tomorrow could invalidate all that follows. Consider it a speculative deep dive – into a policy shift that would become necessary on one quite specific trajectory.

Two claims in particular are loadbearing for what I describe: the notion that advanced AI systems might soon at least temporarily displace services jobs in many economies; and the notion that data will be valuable to build these systems. The first has been discussed elsewhere in much greater detail – I believe it’s not settled, but likely enough not to warrant further explanation in this piece.

The second is the role of data in enabling automation. At the moment, there seem to be two conceivable pathways to advanced AI agents. The first makes do without much specialised data – it builds general systems that first become so intelligent and capable that they can excel in any domain, and then descend onto specific task profiles. That might happen because their intellectual capabilities generally apply across domains, or because their prowess in software engineering specifically causes a degree of self-improvement that allows for indirect generalizations. But lately, there are many reasons to think we’re not on this first path: general returns to scale seem less efficient than narrow reinforcement learning, economic usefulness seems to hinge on many last-mile problems around reliability that are best fixed by doing very specific work, and much economic value seems to be locked behind tricky broad diffusion issues that aren’t obviously bridged fastest by building very capable agents.

Instead, the path to an agent that’s good at something might be to put in a lot of manual work into making it good at that thing. There are many ways in which data from a given economic sector is very helpful in making models significantly better at tasks within that sector. A particularly popular contemporary approach is constructing bespoke reinforcement learning environments used to make models really good at a given task profile. This is the foundational approach of much-noted recent start-ups like Mira Murati’s Thinking Machines or ex-Epoch employees’ Mechanize. This current version of the data-leveraging story is one instance of a more general point: Data controlled by leading white-collar businesses might be very usable for making AI agents better.

How To Sell Your Data

What kind of data might that be? I think there’s a wide range: It can be very narrow, sophisticated data on workflows: SOPs, recordings of employees, or specific inputs they make on specific tasks. It can be slightly broader, results-heavy data: precise outputs from spreadsheets to computer code, or specific deliverables in the context of the original task. Or it can be high volumes of somewhat relevant data – email logs, huge servers full of somewhat pertinent documents, all of which contain some nuggets of information on best professional practice.

Depending on what data turns out to be the most useful, you could imagine different markets emerging: AI developers purchasing it directly, middleman companies purchasing, collecting, and curating data for developers, or more deployment-focused companies fine-tuning models for specific, very narrow use cases. Legacy services companies themselves might become quite good at using their proprietary data to bootstrap narrow AI ambitions. I think there’s a good argument for this market becoming quite important. Just look at the heights to which the infrastructural bottlenecks for AI have driven the Nvidia stock price. If data turns out to be the respective informational bottleneck, it might likewise become quite valuable – for some time, at least.

Still, it’s essential not to overstate the ultimate importance of this data. You might think the above means a restrictive approach to data can save labor forces from displacement altogether. But there are several problems with that thinking: generalisation-based approaches might still catch up, lower-quality data on similar tasks might be acquired elsewhere, or even generated and curated from the ground up. Data would be valuable because it provides an important boost in a neck-and-neck race toward economically viable agents; but not because it’ll remain a binding constraint for the foreseeable future.

Treating Data as an Asset

Returning to the question of national strategy, I believe these trends should have countries recognise that data is a national strategic asset of service economies. This is a controversial, in many places heretical view: Data is still widely understood as individually-owned, individually-controlled, removed from transactional and strategic considerations. A similar view underpins the infamous European GDPR, as well as many analogous laws developed in the spirit of the fabled ‘Brussels effect’. Sometimes, these policies do leave leeway for the choices I describe; in many cases, their most pervasive feature is a political attitude to ‘keep one’s hands off of data’. My strong sense is that policymakers in many of the economies I describe shy away from a leverage-forward view of data.

I believe retaining this position sets countries up for failure. Professional services data is downstream of all the work you’ve invested in building a high-skilled workforce. That has likely been a national effort – requiring investment in education, tax incentives, and costly trade-offs around migration, among other things. The old deal was that this effort would pay dividends over decades, because it boosts your economy and yields high income and corporate taxes. But in the future I described above, that might no longer be the case. The only way to capture the returns of your investment in a quality workforce might now be to cash out on the data this workforce provides. That makes doing something imperative to your national balance sheet – from a strategic point of view, you simply cannot allow yourself to default on the mortgage you’ve taken on your workforce. Given the investments you’ve made, you’re more than justified to wield regulatory power accordingly.

This implies a need for national consolidation. Leaving decisions around how to process this data to companies surrenders control over the asset in ways that are likely to lead to worse outcomes due to a lack of coordination. That is because competitive pressures incentivise early defection. Service economy markets typically feature multiple competitors with very similar business offerings – consultancies, banks, accounting firms, agencies, and so on. If one of them sells, the value of the remaining data can quickly plummet – even more so if there is no broad market for data pipelines, but only a few sources. And there is no guarantee of reasonable reinvestment: For national economies to cash out in a way that confers enduring economic viability, the returns from selling data must be reinvested in some way. Perhaps that’s through receiving an enduring stake in the agents deployed as a result, perhaps it’s just through investing that money into compute, education, and buildouts required for an economic pivot. Perhaps it’s even by leveraging the data into individualised, augmentation-forward AI systems. It’s by no means guaranteed that incidental company-by-company sales contain a viable path toward useful reinvestments.

A New Kind of Data Policy

Moving toward strategically sound leveraging of service economy data requires a different approach to data governance. Practically, there are ways to centrally leverage this kind of data, and consolidate attempts to sell it. One way is simply introducing channels of coordination, and bringing companies together to consolidate their decision-making on this, reducing defection risks through mutual commitments. But that requires additional provisions for ensuring useful reinvestment approaches; perhaps either through making sure tax codes appropriately capture the revenue shift from workers to data sales, or through securing reinvestment pledges by companies. Economies with currently strict data protection laws have a different route: they can keep their strict laws on the books, and instead strategically choose where to allow sales.

The bigger underlying problem is not practical, but dogmatic. Enabling governments to make decisions on this issue breaks with an established view of data, which has long been aimed exclusively at safeguarding individual rights. This view has been entrenched in many jurisdictions, Europe in particular, far beyond its genuine political support. Powerful lobbies of data protection attorneys, themselves created by burdensome data regulations, hold significant sway over data-related decision-making. And political decision-makers have grown fixated on communicating privacy concerns above all else when it comes to data. Pivoting toward capitalising on data is a deeply unpopular position in that environment.

It will be difficult to make the political case as motivated by the concerns outlined above. Unprompted, the ideas I’ve discussed require an awareness for AI trajectories that seems unrealistic in most countries; and they’re set to run into motivated and well-funded opposition. But waiting for more favourable political economies will not do: once the displacement begins and the political window for action opens up, that means systems are already good enough – so companies already have less need for the data. This piece aims to motivate the challenge more so than to develop the mechanism, but I think two angles remain underexplored:

Searching for the Goldilocks Zone

To finish this exploration, let’s assume for a moment you’ve found a way to consolidate decision-making over a relevant amount of data. What to do? The primary challenge will be selecting the optimal time to sell.

It’s tempting to realise the broad strokes of the above argument, overreact, and sell too early. Before bottlenecks manifest, low-hanging fruit fail to suffice, and alternative approaches run aground, there will be little interest in breaking through the very high barriers to accessing privileged data in large swaths. At a time where you’re not quite aware of how big and disruptive the impact of AI on services jobs will be, it might be tempting to sell your data at a reasonably low price – you might think it’s an easy way to cash in on some of the AI boom, take some easy money, and go on on your old economic paradigm. Doing so before you understand that the returns might need to be sufficient to restructure entire economic sectors is a recipe for economic downturn.

For more obvious reasons, it’s easy to sell too late. Competing approaches are one factor – alternative, perhaps synthetic, data sources that circumvent the need for your data, inefficient solutions that are still cheaper than paying you too much; really anything that impatient AI builders might resort to if they can’t get old world governments to budge. Another factor is international competition: especially when your economic structure provides services that are very similar to those offered in other countries, these rivals may secure the sale first and make your data much less valuable.

Getting the timing right requires two factors that are currently quite scarce in national governments. First, keen awareness of the input factors for data value is necessary: you need to closely track the relevant technical developments, as well as what other countries are doing, to find a suitable moment. The second is the ability to execute rapid turnarounds. The government must be able to move quickly on deals and agreements – aware enough to assess the viability of specific exchanges on their merits in a way that doesn’t cause costly delays. That’s a tall ask; realistically, it requires named ownership and having frameworks in place to conduct this assessment well before the fact. If a government – or a private would-be seller of data – only goes around to shop for political approval once a deal is on the table, the delays might well be prohibitive.

Outlook

Pivoting to treating data as a national asset might turn out critically important for service economies. Given the disastrously difficult political economy, it’s worth starting early. As such, I think the best thing to do right now is to build two things: First, data governance structures that actually allow you to make strategic choices around leveraging data if you ever wanted to. A by-default data policy that removes any ability of strategic coordination and productive use is risky – under a permissive regimen, you can quickly miss the window to act. Inversely, a data policy that entrenches an understanding of data as only a matter of individual rights can be a major obstacle for effective data use. Chipping away at that old understanding will be a long and politically arduous task, and perhaps worth embarking on now.

And second, awareness of the issue and its determinants. The timing question depends on plenty of moving technical and economic parts – what goes into leading systems, what are rivals selling, and what’s the price for what data. Countries – especially middle powers committed to the mantra of ‘winning on AI diffusion – currently lack the capacity to track these trends. But the issue of data should really register as another entry in the increasingly long list of reasons to change that: by default, or by just trusting your private sector to develop these capabilities, countries will fail to recoup the investment into their workforce.

Service-focused economies have been dealt a tough hand by the current AI trajectory: their structures are at risk, and they have to time their jump carefully. In one realistic future, their fate will hinge on building data governance that enables them to sell at the right moment. Success can only be found ahead of the curve — which means starting the work on strategic data policy now.